If you think the IRS expects to hear from everybody this time of year, here’s a quote that might surprise you. It’s from an IRS spokesperson I’ve interviewed many times, Mike Dobzinski.

“We get quite a few returns that come in that really don’t have to be filed. If we can discern from what you filed that you’re not required, then we’ll send you back a letter saying that you really don’t have to file a tax return again.”

That’s right: depending on your age, income and filing status, income tax filing is one stressful situation you might be able to avoid. However, if that’s true, you may have stress of a different kind. Because one reason you might not have to file is that you are barely getting by.

And that brings us to this week’s question:

For the last three years we have had our tax returns done for us by AARP volunteers at our senior center. They told us that we did not have to file because of our low income. I have been worried about not filing and would like your opinion on this. I hope they are correct and, if not, what should we do? Thanks!

— David

Who doesn’t have to file a tax return?

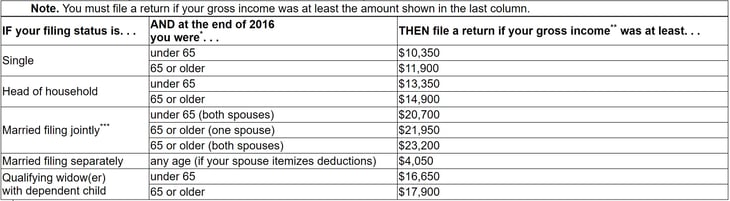

Income cutoffs for filing tax returns can change. Here’s a table summarizing the income thresholds for tax year 2016, from this page of the IRS website. (Click on the table to enlarge.)

Depending on where his income fell on this chart, David probably got good advice from the AARP volunteers at his senior center. Note, however, that these rules are rife with exceptions — hence the asterisks. For example, if you’re claimed as a dependent on someone else’s return, you have to file at much lower income levels. So don’t go by this table alone. Check out the details here.

But while it may sound crazy, there are situations where you’ll want to file even if you don’t have to.

Who should file anyway

You might want to file a tax return when the law doesn’t require it. Why? To reclaim money withheld for taxes, or when you qualify for a refundable tax credit, in other words, money Uncle Sam offers that you can claim even if you didn’t pay any money in.

Here are a couple of common situations when filing could get you money back.

- You had federal income tax withheld. If you had money withheld for taxes and don’t owe taxes, you should obviously file a return so you can get a refund. This also applies if you made estimated tax payments or received overpayment from a prior year applied to this year.

- You qualify for the Earned Income Tax Credit. You might be eligible for the EITC if you worked but didn’t make much. The credit can be up to $6,269 for married couples with three children and adjusted gross incomes of up to $53,505. The credit is refundable, meaning even if you don’t owe or didn’t pay taxes, you can still get a refund check.

Since he’s retired, David probably won’t qualify for the EITC, but he can quickly find out by going to this page of the IRS website.

When in doubt, file

If your 2016 income was less than $54,000, it won’t cost you a dime to get professional help to electronically file a tax return. (See “7 Ways to Get Your Taxes Done for Free.”) And if you’re required to file and don’t, you could be setting yourself up for penalties and interest. So when it doubt, file.

If you file and weren’t required to, the IRS will simply send you a letter saying you don’t have to bother.

Before leaving the topic of people who don’t have to file, let’s explore an additional category of non-filers: people who think they shouldn’t have to file because there’s no law on the books requiring them to.

Does the Constitution require you to file income taxes?

In 1996 — more than 20 years ago — while working out of a newsroom in Cincinnati, I approached the IRS for a comment about people who refused to pay income taxes based on the belief Uncle Sam wasn’t legally authorized to collect them.When I phoned in my interview request, the IRS spokesperson practically bit my head off. To paraphrase, she said this was a stupid topic, they had discussed it a million times and would no longer even dignify it with a response. She added that the government had every right to collect taxes, those who didn’t pay their taxes would lose in court and risk jail time, and anyone suggesting otherwise was either a con artist, a moron or both.

While her tone and words may not have been entirely this scathing, they were close.

Fast forward to today, and the tax protest movement lives on. There’s a website called PayNoIncomeTax.com, ironically authored by someone in prison for tax evasion. There’s a Wikipedia page explaining the tax protester movement. There are articles in respected publications like Forbes asking “Are Tax Protesters Actually Winning?” (Spoiler alert: No, they’re not winning. And they are paying huge penalties.)

This taxes-are-illegal legend that refuses to die has apparently been around since the 1950s. It’s so pervasive, the IRS has published and periodically updates a useful guide, “The Truth About Frivolous (Tax) Arguments.” It offers specific court cases disproving these and other common tax protester arguments:

1. Contention: The filing of a tax return is voluntary. Some taxpayers assert that they are not required to file federal tax returns because the filing of a tax return is voluntary.

2. Contention: Payment of federal income tax is voluntary. In a similar vein, some argue that they are not required to pay federal taxes because the payment of federal taxes is voluntary. Proponents of this position argue that our system of taxation is based upon voluntary assessment and payment.

3. Contention: Taxpayers can reduce their federal income tax liability by filing a “zero return.” Some taxpayers attempt to reduce their federal income tax liability by filing a tax return that reports no income and no tax liability (a “zero return”) even though they have taxable income.

4. Contention: The IRS must prepare federal tax returns for a person who fails to file. Proponents of this argument contend that section 6020(b) obligates the IRS to prepare and sign under penalties of perjury a federal tax return for a person who does not file a return. Thus, those who subscribe to this contention claim that they are not required to file a return for themselves.

5. Contention: Compliance with an administrative summons issued by the IRS is voluntary. Some summoned parties may assert that they are not required to respond to or comply with an administrative summons issued by the IRS.

Each of these contentions is proven false, not by logic, but by court cases, each of which landed the protester in hot water or worse.

Bottom line? Seemingly logical arguments against paying income taxes are exactly the type of thing internet nut cases love to sink their teeth into. Don’t bite. Their arguments are old and specious, and, most important, they won’t hold up in court.

Got a question you’d like answered?

You can ask a question simply by hitting “reply” to our email newsletter. If you’re not subscribed, fix that right now by clicking here. The questions I’m likeliest to answer are those that will interest other readers. In other words, don’t ask for super-specific advice that applies only to you. And if I don’t get to your question, promise not to hate me. I do my best, but I get a lot more questions than I have time to answer.

About me

I founded Money Talks News in 1991. I’m a CPA, and have also earned licenses in stocks, commodities, options principal, mutual funds, life insurance, securities supervisor and real estate. If you’ve got some time to kill, you can learn more about me here.

Got more money questions? Browse lots more Ask Stacy answers here.

Add a Comment

Our Policy: We welcome relevant and respectful comments in order to foster healthy and informative discussions. All other comments may be removed. Comments with links are automatically held for moderation.